US debt ceiling talks continue with new 5 June deadline

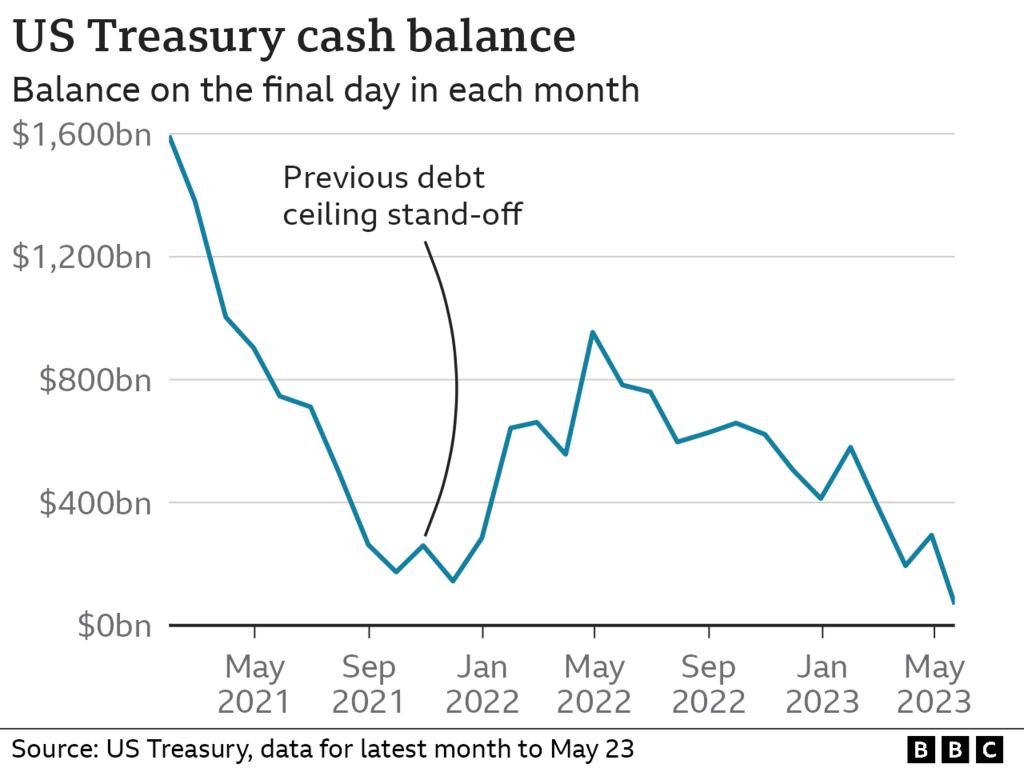

The US treasury secretary has said the country will run out of money to pay its bills on 5 June if lawmakers fail to raise the debt ceiling.

The new deadline allows Republicans and the White House a little more time even as President Joe Biden expressed hope for reaching a deal by Friday night.

An emerging agreement would limit most spending for two years, exempting military and veterans programmes.

Issues such as tougher eligibility for government aid are a sticking point.

Mr Biden told reporters on Friday: “I’m hopeful we’ll know by tonight whether we are going to be able to have a deal.”

US Treasury Secretary Janet Yellen said without a deal the projected resources of the US would be inadequate to meet the country’s spending commitments during the week of 5 June, 10 days away.

Such a default would upend the economy and have global impact.

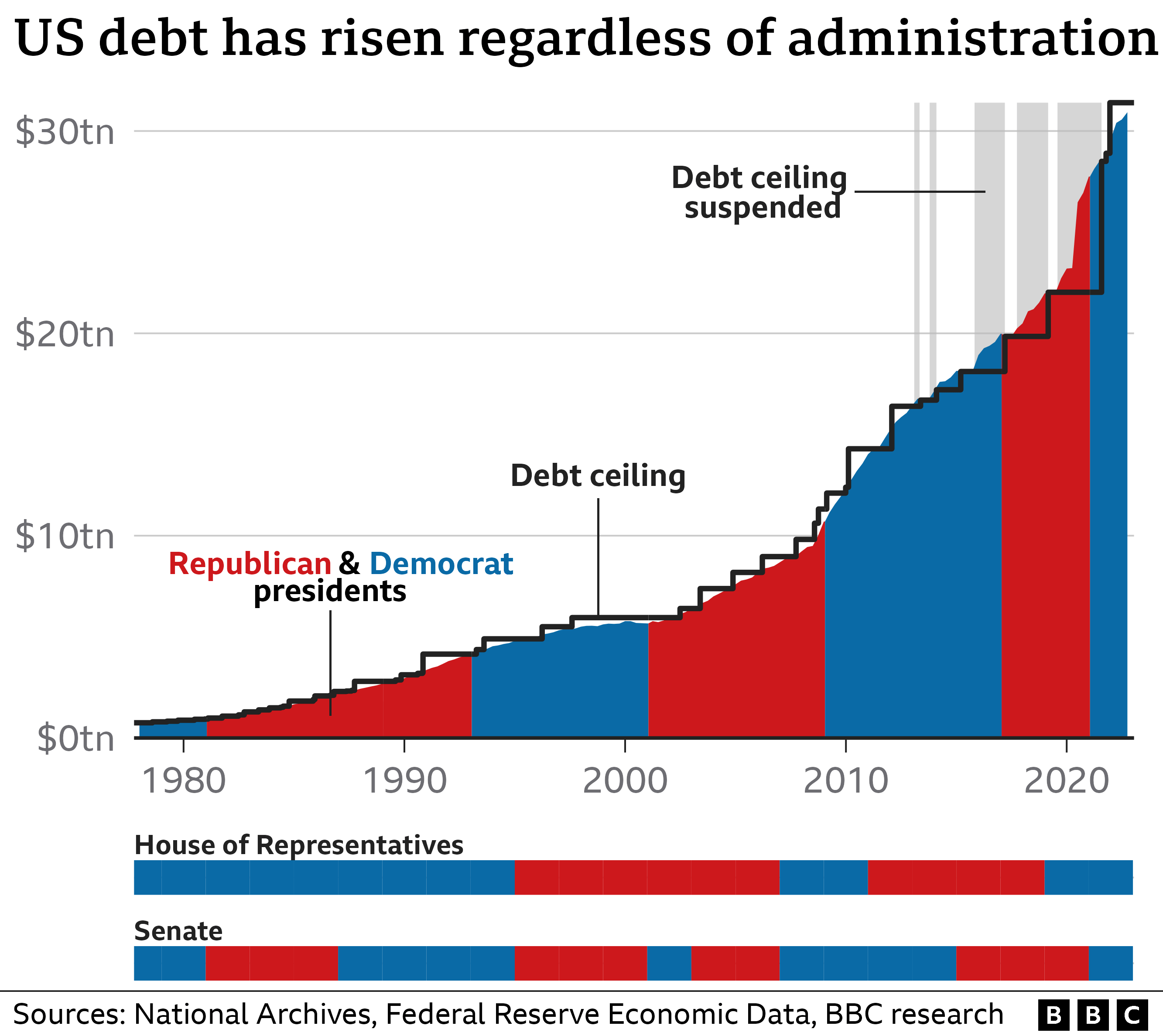

Republicans have been seeking spending cuts in exchange for raising the $31.4tn (£25tn) debt limit, a law which caps how much debt the US government can accrue.

The US Treasury had previously warned the US could run out of money to pay all of its bills as soon as 1 June, unless Congress lifted the limit to allow the government to borrow more.

‘Crunch time’

Kevin McCarthy, who leads Republicans in the House as Speaker, said on Friday that he thought the two sides had “made progress” after working into the night on Thursday.

“We know it’s crunch time,” he said. “I thought we made progress yesterday. I want to make progress again today and I want to be able to solve this problem.”

A day earlier, President Joe Biden also said the negotiations were moving forward, though the White House on Friday afternoon said talks could spill into the weekend.

US media have reported that the emerging deal would raise the debt limit for two years – removing it as a political issue until after the 2024 presidential election.

It could also strip $10bn from the Internal Revenue Service, scaling back the $80bn boost approved last year – despite Republican objections – for the tax collection agency to hire more auditors.

Republican efforts to impose tougher work requirements for recipients of certain government benefits remained a sticking point, however.

Congressional lawmakers have largely returned to their constituencies ahead of the Memorial Day weekend in the US – but have been told to be ready to return in the event of a deal.

The brinksmanship has rattled many observers, who say it erodes confidence in US governance and injects uncertainty into the global financial system.

Earlier this week one of the big credit ratings firms, Fitch Ratings, warned it was considering stripping the US of its top-notch rating, pointing to the fight – a version of which has recurred numerous times over the last decade.

In an assessment of the US economy on Friday, the International Monetary Fund said the US needed to do more to reduce its public debt load, which has increased rapidly in recent decades.

But it urged the country to change its laws to avoid debt-ceiling stand-offs, which it said create an “entirely avoidable systemic risk to both the US and the global economy”.

It said the debt cap should be automatically increased when Congress approves spending.

“To avoid exacerbating downside risks, the debt ceiling should be immediately raised or suspended by Congress, allowing negotiations over the FY2024 budget to begin in earnest,” it added.

The US must borrow money to fund the government because it spends more than it raises in taxes.

Republicans have said they will not raise the debt ceiling unless the government reduces its spending in the years ahead. They are seeking cuts in areas such as education and other social programmes.

Democrats have countered with proposals to raise certain taxes.

The three major US stock indexes jumped on Friday on hopes a deal would be presented soon.

But worries about the impact of a possible default helped drive up US mortgage rates this week and investors are also demanding higher payments in return for some kinds of government bonds.

Any agreement formed between the two sides will need to be turned into a legislative text to be approved by Congress.

Mr McCarthy has promised to give lawmakers 72 hours to review the bill, and at least 24 hours’ notice if they have to return to Washington early. If a deal is reached, a vote could happen early next week.

Some Republicans have already said the potential spending limits appear too modest, while some Democrats have raised opposing concerns.

With Congress already broken up for Memorial Day, there is little wiggle room for objections.

The Senate would also have to vote on the bill, which would then go to the White House for signing.

Lawmakers could also temporarily lift the debt cap to give the talks more time.

Comments (0)