Trump’s tax returns reveal president’s foreign bank accounts

However, they are unlikely to have a major political impact as he eyes another presidential run, experts say.

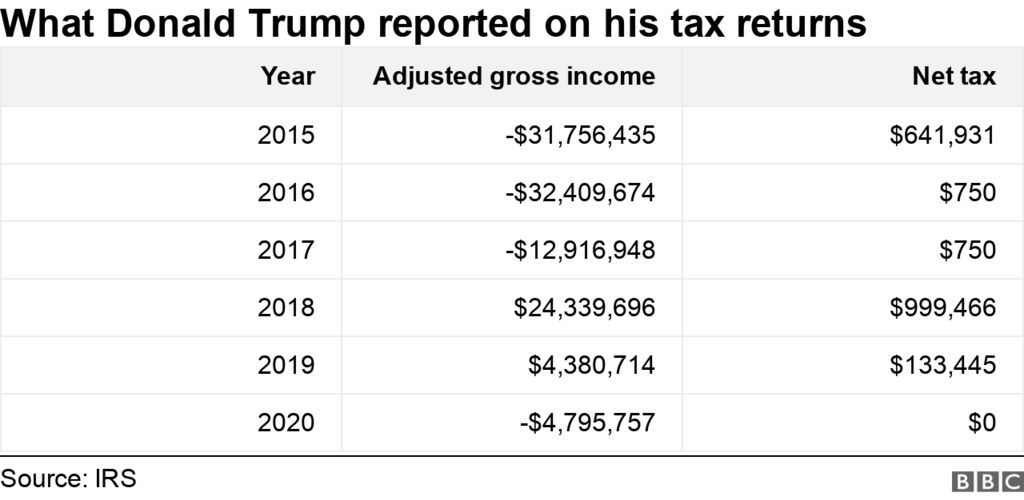

The documents confirmed that Mr Trump paid no federal taxes in 2020 and only $750 (£622) in 2016 and 2017.

He paid close to $1m in 2018, however.

A long legal battle led to the release of the records, and Mr Trump criticised the disclosure, warning that it will deepen the US political divide.

He added that the returns “show how proudly successful I have been and how I have been able to use depreciation and various other tax deductions as an incentive for creating thousands of jobs and magnificent structures and enterprises.”

Although there’s no law requiring it, it is tradition for presidents to publish their tax returns.

US presidents are paid a salary like any worker, but many also earn income from their personal businesses and investments.

The newly released documents include tax returns and related documents for Donald Trump, the Donald J Trump Revocable Trust and seven corporate entities.

They represent only a fraction of the former president’s over 400 separate business interests.

Previously released figures show that Mr Trump paid a total of $1.1m (£906,587) in federal income taxes from 2016 to 2019, all but $1,500 of which was paid in one year. He paid no taxes in 2020, the final year of his presidency.

The documents also show that Mr Trump, who had international business dealings, held bank accounts in Ireland, the United Kingdom and China for a period that ran from 2015-17.

The overseas accounts were notable, as Mr Trump held the White House in 2017, giving him significant power over US foreign policy.

From 2018 onward, Mr Trump only reported having an account in the UK.

The records also show that the Internal Revenue Service – the US federal entity responsible for collecting taxes – did not audit Mr Trump during the first years of his presidency, only beginning in 2019 after Democrats sought to gain access to his tax records.

The finding led to criticism from Democrats. Don Beyer, a member of the committee that oversaw the record release, said that the IRS’ auditing system was broken and that “Congress has so much work to do to make tax enforcement in this country fairer.”

In a memo cited in an earlier report, the IRS noted that “it is not possible to obtain the resources available to examine all potential issues” associated with Mr Trump’s hundreds of business interests.

Maryanne Monforte, a professor of accounting practices at Syracuse University, said the tax returns represent a quagmire even for professionals.

“He’s the quintessential businessman and he’s got his hands in everything,” she said. “He started out in real estate, and that creates a level of complexity between valuations, revenues, losses and depreciation. That all means his return has an added layer of complexity that you might not see with other billionaires.”

Does releasing the tax records matter?

However, experts from both sides of the US political spectrum believe that the returns will have little impact on Mr Trump’s popularity among his core supporters.

“It won’t matter what was in there at all, short of anything that would be a clear legal violation,” said Doug Heye, a former Republican National Committee spokesman.

“There’s no Trump supporter who’s going to say ‘oh, I can’t vote for him now’,” he said. “Even though we haven’t seen Trump’s taxes, we’ve been through this before. This isn’t changing anyone’s minds.”

“Trump voters aren’t going to be moved by anything,” said Democratic strategist Ameshia Cross.

For them, “Quite frankly, I don’t think this matters,” she said, though undecided voters – or Republicans seeking an alternative to Mr Trump – may perceive the documents as showing that his business acumen “wasn’t actually what he was making it out to be”.

“That would mean that the entire campaign that he ran on was basically a lie,” she said. “This showcases something that he had been trying to hide for years.”

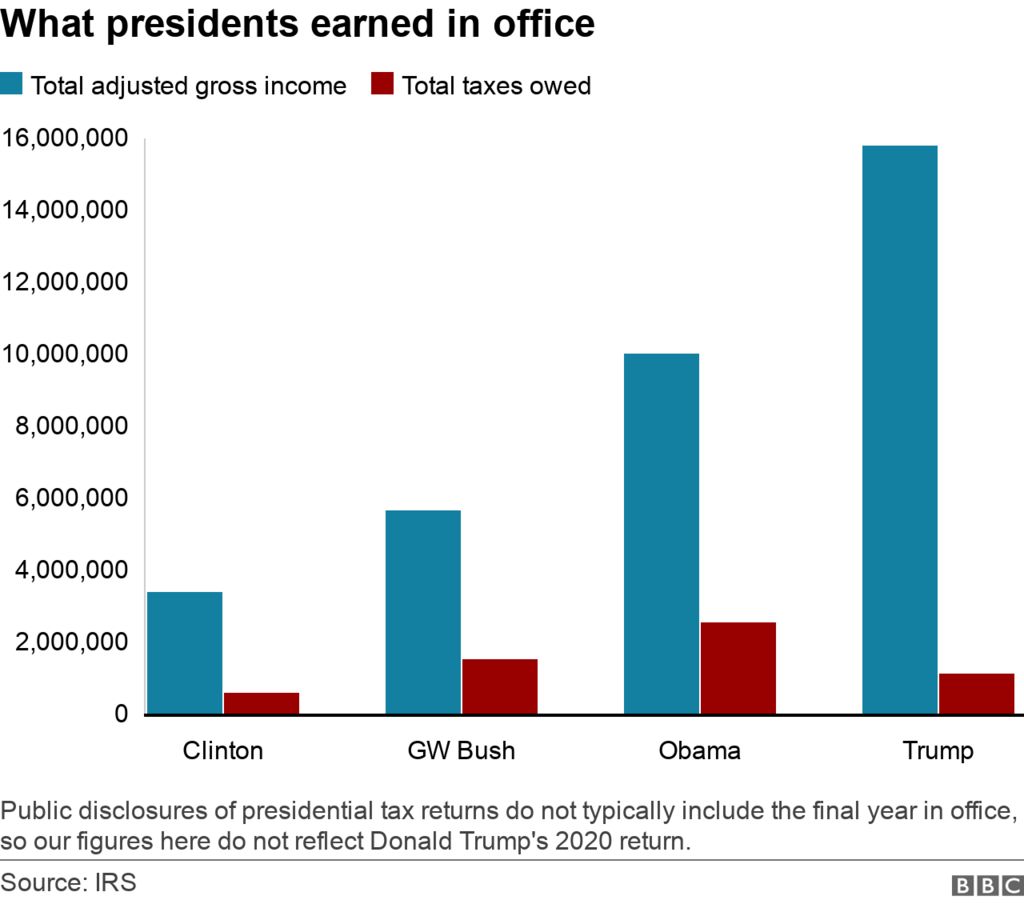

How much taxes have other presidents paid – and how does Trump compare?

In some years, Mr Trump paid a far smaller proportion of his income than other recent presidents. In 2018, he and his wife earned $24.3m in adjusted gross income. But he paid just under $1m, giving him a tax rate of just 4.1%. In America, spouses file together.

In other years, because he reported huge business losses, Mr Trump’s tax burden was actually greater than what he earned on paper. For example, in 2017, he lost money but still paid taxes.

In comparison, Barack Obama and his wife Michelle Obama’s taxable income peaked in 2009, when they took home $5.5m, and paid about 30% in taxes. Most of their income came from the sales of Mr Obama’s two books, Dreams from My Father and Audacity of Hope.

As his book sales dwindled, Mr Obama’s taxable income declined considerably – in 2015, the couple earned just $447,880, almost all from his presidential salary, and paid about 18% of their income to the IRS.

George W Bush did not write his presidential biography until after he left office – while he was president, he and his wife Laura Bush averaged an income of about $800,000 a year. About half came from salaries, and the other half came from interest and investments. They had an average tax rate of 27.8%.

Bill Clinton and his wife Hillary Clinton started off in 1992 making just under $300,000 a year, mostly from salaries, and paying 23.6% of their income to tax. In 1996, Mrs Clinton’s book helped the couple earn over $1m, but their tax rate actually declined to 18.5%.

Comments (0)