Liberty Shoes (NSE:LIBERTSHOE) Takes On Some Risk With Its Use Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, ‘The possibility of permanent loss is the risk I worry about… and every practical investor I know worries about.’ So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Liberty Shoes Ltd. (NSE:LIBERTSHOE) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can’t easily pay it off, either by raising capital or with its own cash flow. If things get really bad, Oofos Shoes the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company’s use of debt, we first look at cash and debt together.

See our latest analysis for Liberty Shoes

How Much Debt Does Liberty Shoes Carry?

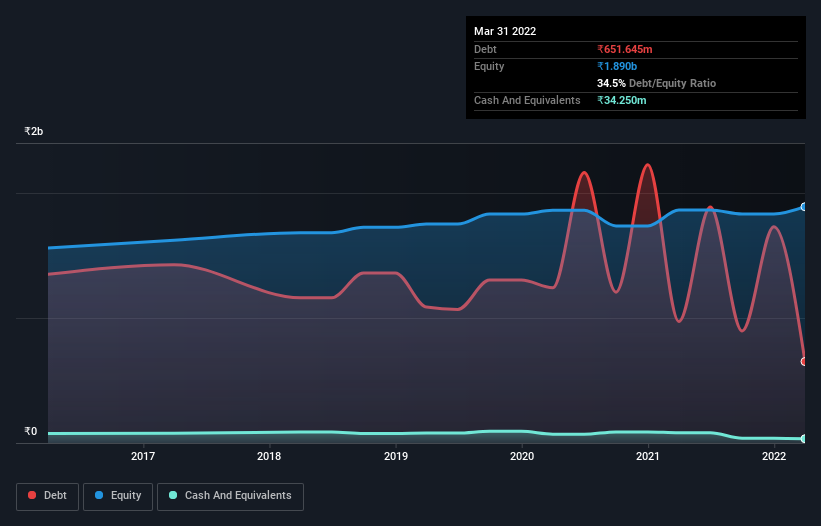

As you can see below, Liberty Shoes had ₹651.6m of debt at March 2022, down from ₹972.3m a year prior. However, it does have ₹34.3m in cash offsetting this, leading to net debt of about ₹617.4m.

A Look At Liberty Shoes’ Liabilities

According to the last reported balance sheet, Liberty Shoes had liabilities of ₹1.53b due within 12 months, and liabilities of ₹902.3m due beyond 12 months. On the other hand, it had cash of ₹34.3m and ₹975.5m worth of receivables due within a year. So it has liabilities totalling ₹1.42b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of ₹2.18b, so it does suggest shareholders should keep an eye on Liberty Shoes’ use of debt. Running Shoes This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company’s debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Given net debt is only 1.4 times EBITDA, it is initially surprising to see that Liberty Shoes’s EBIT has low interest coverage of 1.3 times. So while we’re not necessarily alarmed we think that its debt is far from trivial. Sadly, Liberty Shoes’s EBIT actually dropped 5.9% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. There’s no doubt that we learn most about debt from the balance sheet. But you can’t view debt in total isolation; since Liberty Shoes will need earnings to service that debt. So when considering debt, it’s definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, Liberty Shoes actually Steve Madden Shoes produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Neither Liberty Shoes’s ability to cover its interest expense with its EBIT nor its EBIT growth rate gave us confidence in its ability to take on more debt. But the good news is it seems to be able to convert EBIT to free cash flow with ease. We think that Liberty Shoes’s debt does make it a bit risky, after considering the aforementioned data points together. That’s not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we’ve identified 3 warning signs for Liberty Shoes (1 is concerning) you should be aware of.

Of course, if you’re the type of investor who prefers buying stocks without the burden of debt, then don’t hesitate to discover our exclusive list of net cash growth stocks, today.

Comments (0)